今天要深入了解期貨合約中的兩個重要概念:槓桿和資金費率。這就像農業中的借貸經營一樣,爸爸有時會借錢擴大種植規模(槓桿),但借錢是要付利息的(資金費率)。理解這些機制對期貨交易至關重要!

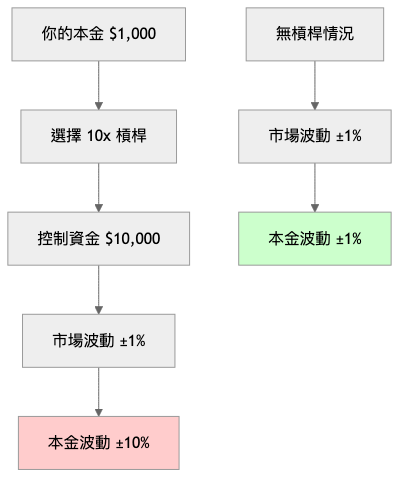

槓桿就像是向銀行借錢來擴大投資規模:

| 槓桿倍數 | 保證金需求 | 價格變動1% | 本金影響 | 風險等級 |

|---|---|---|---|---|

| 1x (現貨) | 100% | ±1% | ±1% | 低 |

| 5x | 20% | ±1% | ±5% | 中 |

| 10x | 10% | ±1% | ±10% | 高 |

| 25x | 4% | ±1% | ±25% | 極高 |

| 100x | 1% | ±1% | ±100% | 極度危險 |

class LeverageCalculator:

"""槓桿交易計算器"""

def __init__(self, initial_capital=1000):

self.initial_capital = initial_capital

def calculate_position(self, leverage, entry_price):

"""計算槓桿倉位"""

# 可控制的名義價值

notional_value = self.initial_capital * leverage

# 可購買的數量

position_size = notional_value / entry_price

# 所需保證金

margin_required = notional_value / leverage

return {

'leverage': leverage,

'notional_value': notional_value,

'position_size': position_size,

'margin_required': margin_required,

'margin_ratio': margin_required / self.initial_capital

}

def calculate_pnl(self, leverage, entry_price, exit_price, position_size):

"""計算損益"""

# 價格變動

price_change = exit_price - entry_price

price_change_percent = price_change / entry_price

# 絕對損益

absolute_pnl = position_size * price_change

# 相對於本金的損益

capital_pnl_percent = absolute_pnl / self.initial_capital

return {

'price_change': price_change,

'price_change_percent': price_change_percent,

'absolute_pnl': absolute_pnl,

'capital_pnl_percent': capital_pnl_percent,

'leverage_multiplier': capital_pnl_percent / price_change_percent

}

def liquidation_price(self, leverage, entry_price, side='long'):

"""計算強制平倉價格"""

# 維持保證金率(通常為初始保證金的50%)

maintenance_margin_rate = 0.5 / leverage

if side == 'long':

# 做多的強平價格

liquidation_price = entry_price * (1 - maintenance_margin_rate)

else:

# 做空的強平價格

liquidation_price = entry_price * (1 + maintenance_margin_rate)

return liquidation_price

# 實際計算範例

calculator = LeverageCalculator(initial_capital=1000)

# 10倍槓桿做多 BTC

leverage = 10

entry_price = 50000

position = calculator.calculate_position(leverage, entry_price)

print(f"10倍槓桿交易分析:")

print(f"可控制價值: ${position['notional_value']:,.0f}")

print(f"可買數量: {position['position_size']:.4f} BTC")

print(f"需要保證金: ${position['margin_required']:,.0f}")

# 計算不同價格情況下的損益

scenarios = [45000, 48000, 50000, 52000, 55000]

print(f"\n價格情境分析:")

for exit_price in scenarios:

pnl = calculator.calculate_pnl(leverage, entry_price, exit_price, position['position_size'])

print(f"價格 ${exit_price:,}: 損益 {pnl['capital_pnl_percent']:.1%}")

# 計算強平價格

liquidation = calculator.liquidation_price(leverage, entry_price, 'long')

print(f"\n強制平倉價格: ${liquidation:,.0f}")

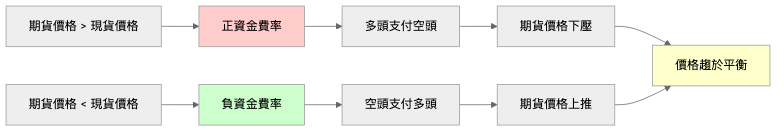

資金費率(Funding Rate)是永續合約特有的機制,用來維持期貨價格接近現貨價格:

class FundingRateAnalyzer:

"""資金費率分析器"""

def __init__(self):

self.funding_interval = 8 # 8小時收取一次

def calculate_funding_rate(self, premium_index, interest_rate=0.01):

"""計算資金費率"""

# 基礎利率(通常為0.01%)

base_rate = interest_rate / 100

# 溢價指數(期貨相對現貨的溢價)

premium_component = premium_index

# 資金費率 = 基礎利率 + 溢價組件

funding_rate = base_rate + premium_component

# 限制在 ±0.75% 範圍內

funding_rate = max(min(funding_rate, 0.0075), -0.0075)

return funding_rate

def calculate_funding_cost(self, position_value, funding_rate):

"""計算資金費用"""

# 每8小時的資金費用

funding_cost = position_value * funding_rate

# 年化成本

daily_cost = funding_cost * 3 # 一天3次

annual_cost = daily_cost * 365

annual_rate = annual_cost / position_value

return {

'funding_cost_per_period': funding_cost,

'daily_cost': daily_cost,

'annual_cost': annual_cost,

'annual_rate': annual_rate

}

def funding_arbitrage_opportunity(self, spot_price, futures_price,

predicted_funding_rate):

"""分析資金費率套利機會"""

premium = (futures_price - spot_price) / spot_price

# 如果資金費率異常高,可以考慮套利

if predicted_funding_rate > 0.001: # 0.1%

strategy = {

'action': 'funding_arbitrage',

'spot_position': 'buy',

'futures_position': 'sell',

'expected_funding_income': predicted_funding_rate,

'risk': 'basis_risk'

}

elif predicted_funding_rate < -0.001: # -0.1%

strategy = {

'action': 'reverse_funding_arbitrage',

'spot_position': 'sell',

'futures_position': 'buy',

'expected_funding_income': abs(predicted_funding_rate),

'risk': 'basis_risk'

}

else:

strategy = {

'action': 'hold',

'reason': 'funding_rate_normal'

}

return strategy

# 資金費率分析範例

analyzer = FundingRateAnalyzer()

# 計算當前資金費率

spot_price = 50000

futures_price = 50200

premium_index = (futures_price - spot_price) / spot_price

funding_rate = analyzer.calculate_funding_rate(premium_index)

print(f"當前資金費率: {funding_rate:.4%}")

# 計算持倉成本

position_value = 10000 # $10,000 倉位

funding_cost = analyzer.calculate_funding_cost(position_value, funding_rate)

print(f"每8小時資金費用: ${funding_cost['funding_cost_per_period']:.2f}")

print(f"每日資金費用: ${funding_cost['daily_cost']:.2f}")

print(f"年化費率: {funding_cost['annual_rate']:.2%}")

# 套利機會分析

arbitrage = analyzer.funding_arbitrage_opportunity(

spot_price, futures_price, funding_rate

)

print(f"套利建議: {arbitrage}")

import pandas as pd

import numpy as np

import matplotlib.pyplot as plt

def analyze_funding_rate_patterns():

"""分析資金費率模式"""

# 模擬歷史資金費率數據

dates = pd.date_range('2024-01-01', '2024-12-31', freq='8H')

np.random.seed(42)

# 生成帶趨勢的資金費率

base_rate = 0.0001

trend = np.sin(np.arange(len(dates)) * 2 * np.pi / (365 * 3)) * 0.0002

noise = np.random.normal(0, 0.0001, len(dates))

funding_rates = base_rate + trend + noise

funding_df = pd.DataFrame({

'timestamp': dates,

'funding_rate': funding_rates

})

# 分析統計特徵

stats = {

'mean_funding_rate': funding_df['funding_rate'].mean(),

'std_funding_rate': funding_df['funding_rate'].std(),

'positive_rate_ratio': (funding_df['funding_rate'] > 0).mean(),

'extreme_positive_ratio': (funding_df['funding_rate'] > 0.001).mean(),

'extreme_negative_ratio': (funding_df['funding_rate'] < -0.001).mean()

}

# 計算累積成本

funding_df['cumulative_cost'] = funding_df['funding_rate'].cumsum()

return funding_df, stats

# 執行分析

funding_data, funding_stats = analyze_funding_rate_patterns()

print("資金費率統計分析:")

print(f"平均資金費率: {funding_stats['mean_funding_rate']:.4%}")

print(f"資金費率標準差: {funding_stats['std_funding_rate']:.4%}")

print(f"正費率比例: {funding_stats['positive_rate_ratio']:.1%}")

print(f"極端正費率比例 (>0.1%): {funding_stats['extreme_positive_ratio']:.1%}")

print(f"極端負費率比例 (<-0.1%): {funding_stats['extreme_negative_ratio']:.1%}")

class ConservativeLeverageStrategy:

"""保守槓桿策略"""

def __init__(self, max_leverage=3, stop_loss=0.05):

self.max_leverage = max_leverage

self.stop_loss = stop_loss

self.position_size_ratio = 0.1 # 每次最多用10%資金

def calculate_position_size(self, account_balance, confidence_level):

"""根據信心水平計算倉位"""

# 基礎倉位

base_position = account_balance * self.position_size_ratio

# 根據信心水平調整

adjusted_position = base_position * confidence_level

# 根據槓桿計算實際控制價值

controlled_value = adjusted_position * self.max_leverage

return {

'margin_used': adjusted_position,

'controlled_value': controlled_value,

'leverage_used': self.max_leverage,

'risk_percentage': adjusted_position / account_balance

}

def risk_management_rules(self):

"""風險管理規則"""

rules = {

'max_leverage': self.max_leverage,

'stop_loss': self.stop_loss,

'max_daily_trades': 3,

'max_portfolio_risk': 0.2, # 最多用20%資金

'profit_taking': 0.1, # 10%獲利了結

'trailing_stop': 0.03 # 3%追蹤止損

}

return rules

class DynamicLeverageManager:

"""動態槓桿管理"""

def __init__(self):

self.volatility_threshold = {

'low': 0.02, # 2% 日波動

'medium': 0.05, # 5% 日波動

'high': 0.10 # 10% 日波動

}

self.leverage_mapping = {

'low': 10, # 低波動可用高槓桿

'medium': 5, # 中波動用中槓桿

'high': 2 # 高波動用低槓桿

}

def calculate_optimal_leverage(self, current_volatility, market_trend):

"""計算最優槓桿倍數"""

# 根據波動性確定基礎槓桿

if current_volatility <= self.volatility_threshold['low']:

base_leverage = self.leverage_mapping['low']

volatility_level = 'low'

elif current_volatility <= self.volatility_threshold['medium']:

base_leverage = self.leverage_mapping['medium']

volatility_level = 'medium'

else:

base_leverage = self.leverage_mapping['high']

volatility_level = 'high'

# 根據市場趨勢調整

trend_multiplier = {

'strong_trend': 1.2, # 強趨勢增加槓桿

'weak_trend': 0.8, # 弱趨勢減少槓桿

'sideways': 0.6 # 震盪市場大幅減少槓桿

}.get(market_trend, 1.0)

optimal_leverage = base_leverage * trend_multiplier

optimal_leverage = max(min(optimal_leverage, 20), 1) # 限制在1-20倍

return {

'optimal_leverage': optimal_leverage,

'volatility_level': volatility_level,

'base_leverage': base_leverage,

'trend_multiplier': trend_multiplier,

'recommendation': self._get_leverage_recommendation(optimal_leverage)

}

def _get_leverage_recommendation(self, leverage):

"""獲取槓桿建議"""

if leverage <= 3:

return "保守,適合新手"

elif leverage <= 5:

return "穩健,適合有經驗者"

elif leverage <= 10:

return "積極,需要豐富經驗"

else:

return "激進,極高風險"

# 使用範例

leverage_manager = DynamicLeverageManager()

# 分析不同市場條件下的最優槓桿

market_scenarios = [

{'volatility': 0.015, 'trend': 'strong_trend'},

{'volatility': 0.035, 'trend': 'weak_trend'},

{'volatility': 0.08, 'trend': 'sideways'}

]

for i, scenario in enumerate(market_scenarios, 1):

result = leverage_manager.calculate_optimal_leverage(

scenario['volatility'], scenario['trend']

)

print(f"\n情境 {i}:")

print(f"波動率: {scenario['volatility']:.1%}")

print(f"趨勢: {scenario['trend']}")

print(f"建議槓桿: {result['optimal_leverage']:.1f}x")

print(f"建議: {result['recommendation']}")

class LeverageBestPractices:

"""槓桿交易最佳實踐"""

@staticmethod

def risk_management_checklist():

"""風險管理檢查清單"""

checklist = {

'before_trading': [

'確定交易計劃和策略',

'設定清晰的止損點',

'計算最大可承受損失',

'確保充足的保證金緩衝',

'檢查市場流動性'

],

'during_trading': [

'嚴格執行止損',

'避免情緒化決策',

'不要臨時改變計劃',

'監控保證金水平',

'記錄交易決策原因'

],

'after_trading': [

'分析交易結果',

'檢討決策過程',

'更新交易日誌',

'評估策略有效性',

'準備下次交易'

]

}

return checklist

@staticmethod

def leverage_selection_guide():

"""槓桿選擇指南"""

guide = {

'beginner': {

'recommended_leverage': '1-3x',

'max_position_size': '5-10%',

'focus': '學習和經驗累積',

'goal': '保本並理解機制'

},

'intermediate': {

'recommended_leverage': '3-5x',

'max_position_size': '10-15%',

'focus': '策略開發和優化',

'goal': '穩定獲利'

},

'advanced': {

'recommended_leverage': '5-10x',

'max_position_size': '15-25%',

'focus': '風險收益最佳化',

'goal': '最大化風險調整後收益'

},

'professional': {

'recommended_leverage': '可變',

'max_position_size': '根據策略調整',

'focus': '複雜策略和套利',

'goal': '絕對收益和風險控制'

}

}

return guide

# 展示最佳實踐

practices = LeverageBestPractices()

print("槓桿交易風險管理檢查清單:")

checklist = practices.risk_management_checklist()

for phase, items in checklist.items():

print(f"\n{phase.upper()}:")

for item in items:

print(f" ☐ {item}")

print("\n\n槓桿選擇指南:")

guide = practices.leverage_selection_guide()

for level, details in guide.items():

print(f"\n{level.upper()}:")

for key, value in details.items():

print(f" {key}: {value}")

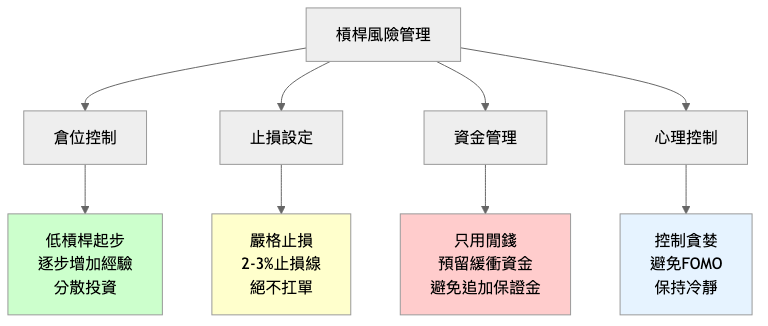

今天我們深入學習了期貨合約中的槓桿和資金費率機制,就像學會了農業借貸經營的精髓。重要概念包括:

槓桿交易要點:

資金費率機制:

風險管理策略:

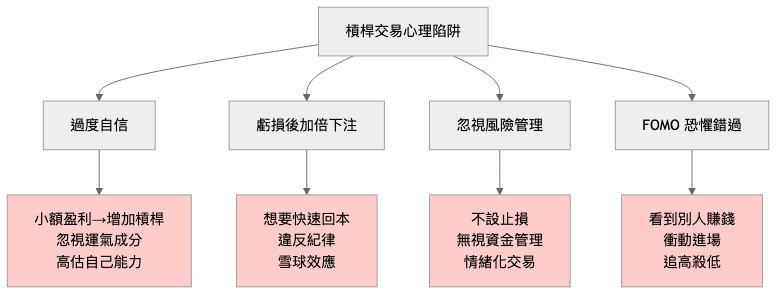

心理素質培養:

記住爸爸說過的話:「借錢種田能放大收益,但也可能讓你傾家蕩產」。槓桿交易也是如此,必須謹慎使用,量力而行!

明天我們將探討回測、虛擬單和上線的完整流程,學習如何系統性地開發和部署交易策略。

下一篇:Day 22 - 探討回測、虛擬單、上線